2022 State of the ESP RFP Survey Results and Conclusions

In late 2020, Email Connect and Only Influencers put out our first survey of the RFP landscape. We were interested in looking at the impact the COVID-19 pandemic had on brands’ plans for ESP RFPs during 2020. Among our survey respondents, 40% of those who had originally planned to conduct an RFP postponed or canceled those plans, representing a major disruption to business as usual in 2020.

At the end of 2021, we decided to survey brands again on their RFP activity to see if there were continued disruptions to business as usual, or if things were beginning to return to “normal”. As in 2020, we included some questions pertaining to what platform features and functions email marketers are most interested in exploring in their RFPs. And we again asked which ESPs were most interesting to brands contemplating an RFP.

The results are more anecdotal than scientific, but they nevertheless provide some very good insight into the upcoming RFP landscape and what brands will be looking for.

About the Survey Respondents

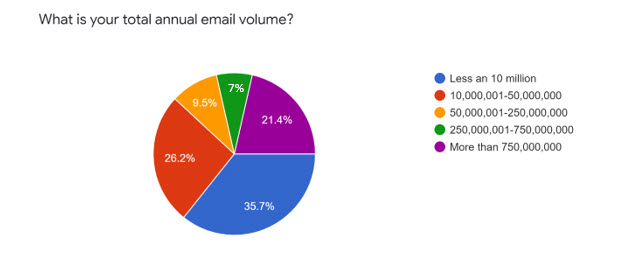

Again in 2022, we got a good mix of companies responding to the survey. Brands ranged in size from the top of the SMB category all the way up to enterprise-sized email volumes. This chart shows how they break out by email volume:

The range of email volumes is valuable as it enables us to see where send quantities have an impact on attitudes and needs.

Lingering Impact of COVID-19?

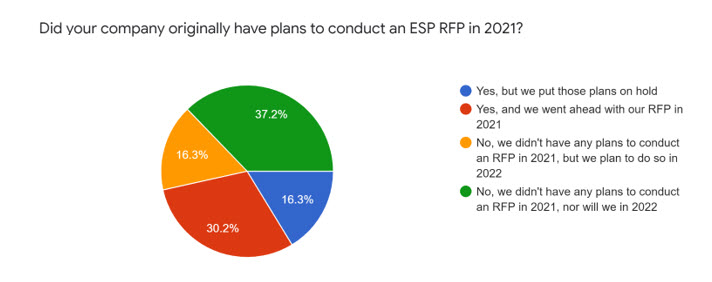

Among our survey respondents, 35% of those who originally planned to conduct a 2021 RFP postponed or canceled those plans (that’s 16% of total respondents). That is not far off of the 40% who canceled in 2020, indicating that the effects of the pandemic are still impacting decisions by brands regarding RFPs.

Those who postponed or canceled RFPs represented the full range of respondents, as did those who went ahead with their RFPs. This is a change from last year when the highest and the lowest volume senders were the most likely to go ahead with their RFP plans.

What this year’s numbers tell us is that COVID-19 is continuing to impact decisions made by companies regarding plans to RFP or not. Remote work, the inability to travel, and the bottom line all combine to make RFPs harder to manage.

What about the RFPs that didn’t happen in 2021?

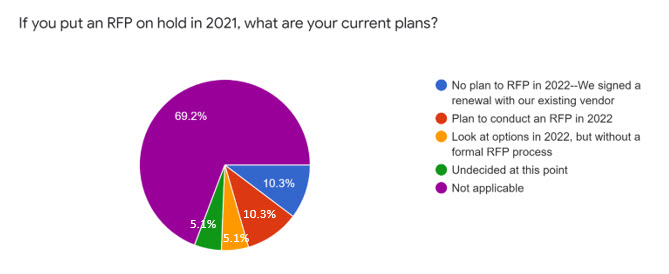

One-third of the brands (10% of respondents) that postponed plans to do an RFP in 2021 ended up signing renewals with their existing vendors. Another third plan to conduct the RFP in 2022. The remaining third is either going to look at their options without a formal review process or are still undecided. While 2021 was a big year for ESP RFPs, the continued push out of a number of RFPs indicates 2022 will be another big year.

What is the Primary Driver of your RFP?

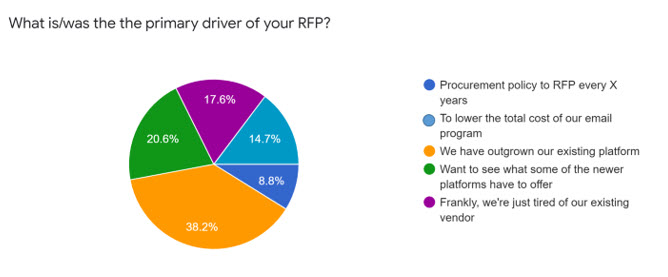

Here is where the results start to deviate from our previous survey. In a big change from the previous year, “Frankly we’re just tired of our existing vendor” jumped as the primary driver of RFPs from 5% of respondents in 2020 to 18% in 2021. One can hypothesize that having to delay a planned RFP due to COVID made frustrations with an existing vendor more painful and pronounced. We will have to see if this trend continues into 2023.

This increase came primarily at the expense of the top two drivers of RFPs in our last survey, “We have outgrown our existing platform” (39%) and “Want to see what some of the newer platforms have to offer” (18%). It is too early to say if this indicates a slight cooling off of interest in the new “next-gen” platforms or is merely a reflection of growing frustration with existing ESP partners.

Planning an RFP to lower the cost of a brand’s email marketing program dipped slightly from nearly 18% last year to just over 15% in this year’s survey. It is not clear whether this is because brands are generally happy with their pricing, or from a lack of understanding as to where the market is today in terms of pricing. From our RFP work with brands it has become clear to us that several vendors are charging existing customers significantly more than market pricing. Depending on who your ESP is, and how long you have been a customer, you might be pleasantly surprised in your next RFP, even if getting a better deal is not your primary driver.

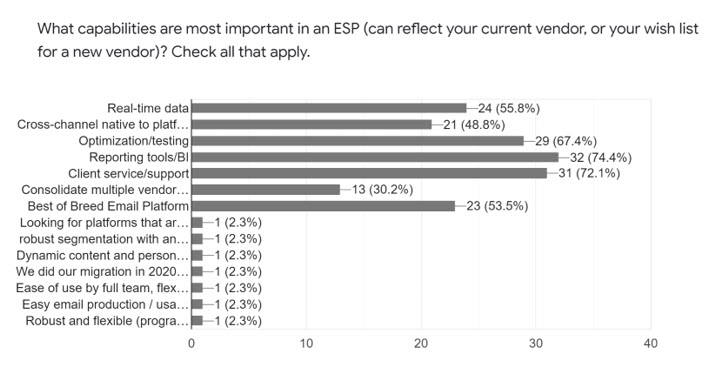

What capabilities are most important in an ESP?

The answers to this question again this year prove that many vendors talk the least about the things that are most important to the folks at the brands. As we reported last year, part of the reason for this lies in the fact that many vendors want to appeal to the C-Suite at prospects, so they shun the ESP label and focus on how they can fundamentally change a brand’s business outcomes. You know, as in “digital transformation.” But the people doing the selecting at most brands are looking for a platform they still call an ESP and are interested in how it can help make their email marketing better.

For the second year in a row, “Reporting tools/BI” topped the list of most desired capabilities, with 74% of respondents listing it as one of the most important capabilities. Making a big move up this year, and coming in as the second most important capability with 72% of respondents listing it, is “Client service/support.” That is significantly higher than the 50% it received last year. We are not surprised by its second place finish this year—last year was the bigger surprise! From our RFP experience, client service and support are always a big factor in the decision-making process, even for brands that are going to operate in a completely self-service mode. For the “next-gen” platforms who have positioned themselves as tech companies to appeal to Wall Street, this result should potentially be of concern.

Real-time data finished fourth this year (nearly 56%), dropping two places from last year’s second-place finish. Also moving up in importance is “Optimization/testing” which finished as the third most important (67%). The drop in importance of real-time data to our respondents is possibly the result of a growing interest in CDPs, which are increasingly seen as providing this key function. This year we added a new question around CDP adoption which we will get to shortly.

Hot or Not

We again asked the respondents, if they were to start an RFP tomorrow, who are three vendors they would be sure to include. Some of the popular ESPs from last year were not quite as popular this time around. For the second year in a row, Iterable was one of the two ESPs most often mention, joined this year by Braze. Salesforce Marketing Cloud and Klaviyo also remained among the most popular.

The range of platforms that got a mention indicates there is still a lot of confusion around who to include in an email RFP. Some mobile marketing platforms got mentions, as well as a number of “cheap & cheerful” ESP platforms that have no business in an RFP against mid-market and enterprise platforms. As we noted last year, this can create a scenario where a brand will start an RFP with a very wide range of ESP sizes. This is not a good thing. “Cheap & cheerful” ESPs fit a certain type of email marketer, whereas enterprises fit a very different type. Brands need to be comparing apples to apples when looking at their options.

Where do CDPs Fit in the Picture?

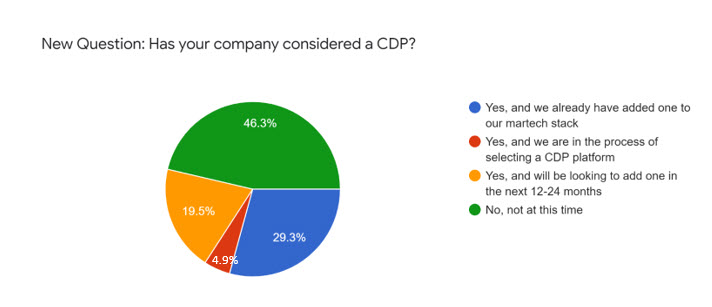

CDPs burst on the martech scene as “the next big thing” a few years back. We wrote back in 2020 that there was going to be a head-on collision of ESPs and CDPs in the near future since there was so much overlap in their capabilities. Since that time several of the enterprise ESPs (like Zeta Global) evolved their platforms to include what we call a “CDP Inside”. At the same time, several CDPs (like BlueShift) added some rudimentary email capabilities to their platforms. Which shows that our prediction of the eventual merger of these platforms is already coming to pass.

So our survey asked about CDP adoption at the companies that responded. As you can see from the chart below, nearly 28% of respondents said their companies had already added a CDP to their martech stack. Another 25% are either looking for a CDP now, or plan to do so within the next 24 months. That leaves just under half of our respondents without any plans, at the moment, to add a CDP. In the long run, this might prove to be the right move as these two platforms continue to merge into something like a Messaging CDP or a Data Platform ESP.

Summary of Findings

- COVID-19 continued to have an impact on the timing of RFPs into 2021.

- Like the previous year, 2022 is going to be a big year for ESP RFPs, but many RFPs originally planned for 2021 will never happen.

- While a growing sense among email marketers that they are “missing out” on better technology continues to be the main drivers of why brands RFP, unhappiness with an existing ESP partner is increasingly a cause for brands to start an RFP.

- Client service is also increasing in importance as something sought by brands in a new ESP. This could have major implications for many of the “next gen” platforms.

- SFMC is the top-of-mind legacy ESP appealing to brands across all levels of email volume; matched by “next gen” platforms Iterable and Braze.

- CDPs are increasingly joining ESPs in the martech stack, though some brands might want to wait a little longer before diving in.

RFPs are increasingly harder to manage successfully in a fast-changing vendor landscape populated by a number of legacy and “next gen” platforms all of whom are competing for the same business. Ongoing platform innovations, CDPs, and an increasing need for 1st party data is going to have increasing influence on how brands perceive the various ESPs, and how the ESPs position themselves for success in the marketplace.

The stakes of getting your RFP right have never been higher. And the selection process has never been more difficult.

Photo by Towfiqu barbhuiya on Unsplash

Photo by Towfiqu barbhuiya on Unsplash

How to resolve AdBlock issue?

How to resolve AdBlock issue?