ESPs and CDPs Have Collided. Get Ready for ESCDPs!

I wrote the following back in June of 2020:

…let’s take a look at what a CDP is supposed to do.

1. Data Aggregation : Organize all customer data and keep it available for immediate use. Some technical resources are required to set up and maintain the CDP, but they don’t require the level of technical skill needed to operate a traditional data warehouse.

2. Data Unification : Combine data from multiple online and offline locations to create a unified single customer view. This 360-degree view of the customer is possible due to the fact that all customer data is located in one central location.

3. Data Deployment : On demand deployment of data to 3rd party systems focused on adtech and campaign delivery.

Right about now many of you might be thinking to yourselves, “Hold on one minute, that sounds suspiciously like what I get from my ESP!” And you’d be right. Many mid-market and enterprise ESPs have evolved into tools that help brands manage the entirety of a customer relationship, including:

- communications via email and other channels

- sync with third-party systems via batch and/or real-time methods

- out-of-the-box API's and data export functionality

- ability to capture additional profile attributes where missing and/or enhance with 3rd party data sources

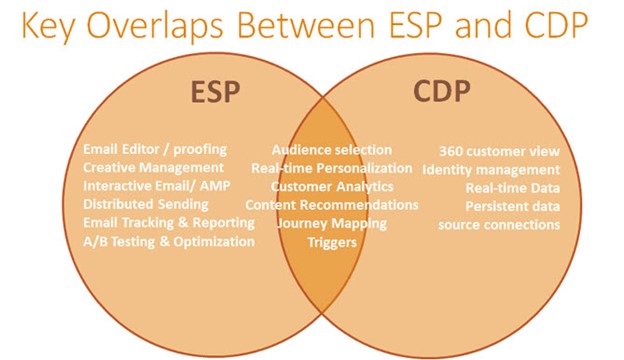

This would seem to imply, then, that there is a lot of overlap between certain ESP platforms and CDPs. You bet there is, and it’s big. This diagram points out some of these overlaps, but it only scratches the surface.

Fast forward to 2022

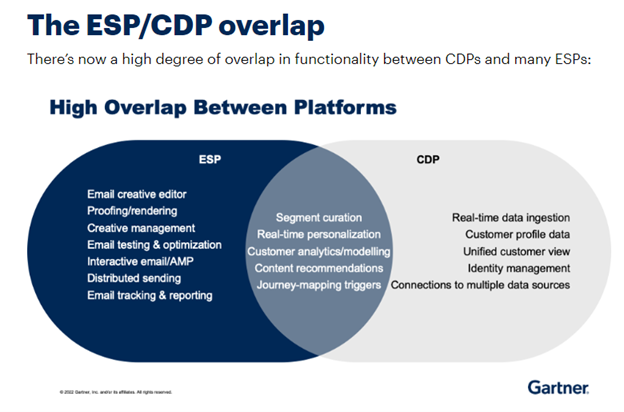

In March Gartner Group also predicted that CDPs and ESPs were on a collision course due to the fact that there are a lot of overlapping capabilities.

Notice the similarities between the language and diagrams? I mean, they had two years to come up with something, but instead they "borrowed" from me! Perhaps the bigger point to make here, however, is the fact that just when Gartner finally makes a prediction about an upcoming collision, in reality that collision actually occurred in 2022 -- much sooner than even I thought -- and the fall-out from that collision is changing both the CDP and ESP vendor landscapes in very significant ways.

How is the Landscape Changing Post-Collision?

The initial response by many ESPs two years ago to the approaching collision was to essentially put a “CDP Inside” their platforms. These ESP platforms with “CDP Inside” provided clients with the option to bundles both services at one vendor. Each platform could operate independently of the other—and were often also sold independently—or they could be sold as a package.

One of the challenges of this scenario was that buyers of CDPs at that time tended to be data/IT teams, while the traditional buyer of ESPs is the marketing team. Marketers who were interested in having more CDP-like capabilities in their platforms were often forced to stand by while the data/IT team at their organization conducted its own CDP search that focused on their specific needs. And that practice continues today. Every single RFP we’ve run in the last 12 months has had a parallel search for a CDP, but by a different team in the organization—typically, as I’ve said, by the IT/data team. But in the post-collision environment new platforms are emerging which potentially (from the perspective of the marketer) solve this dilemma. These are CDPs that can actually deploy email campaigns on the CDP side, and ESPs that have data and analytic capabilities that can replicate many of the tasks normally associated with CDPs.

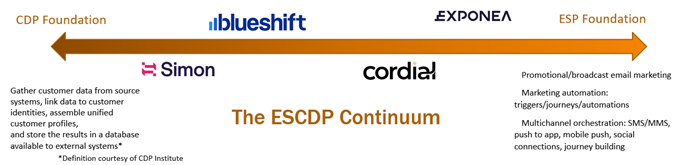

In other words, today there are certain CDPs and ESPs which are barely distinguishable from one another. In fact, they are so much alike they are two sides of the same coin. I call these platforms ESCDPs for lack of a better acronym. Four good examples of ESCDPs are—from the CDP world—Blueshift (https://blueshift.com/) and Simon Data (https://www.simondata.com/). And from the ESP world, Cordial (https://cordial.com/) and Exponea, which was acquired by Bloomreach in early 2021 (https://exponea.com/). Please note that I am neither endorsing any of these platforms, nor am I promoting them. I am using them as good examples of where I see the vendor landscape evolving in the near future, at least at the mid-market served by these platforms.

What this graphic is attempting to show is that these new ESCDPs can handle the basic functions of both CDPs and ESPs, but their strengths lie in different places along the continuum. Which is only logical given that some started life as a CDP, and others as ESPs.

What is driving the development of ESCDPs? First, marketers are coming to understand that CDPs are no longer the only best sources of data. Many ESPs are closing the gap. And second, marketers are increasingly interested in having fewer, not more, vendors. They don’t want to outsource data management and segment-building to other parts of their organizations. They want to have all the real-time data at their fingertips for the campaigns they deploy.

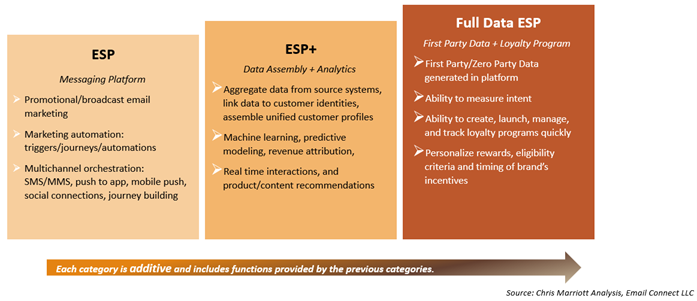

The emergence of ESCDPs has re-arranged the vendor landscape on the ESP side. As I see it, there are now 3 main categories of platform:

Within each of these 3 categories there still remain huge differences between the platforms themselves, but this way of looking at the landscape allows us to begin to see how the vendors are adapting to the post-collision world of ESPs and CDPs. I should also note that there are not hard borders around these 3 categories, there’s some room in between them.

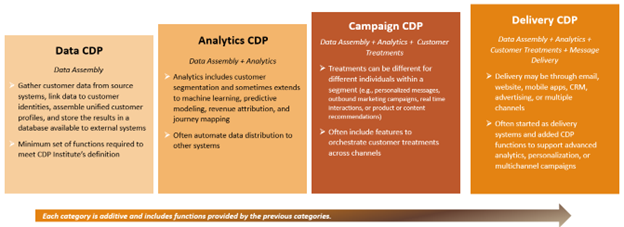

So if that’s how ESPs are adapting, what about the CDP landscape? I think the best view is the CDP landscape was created by the CDP Institute:

Source: https://www.cdpinstitute.org/learning-center/what-is-a-cdp/#section2

In general, data and IT teams have gravitated towards the first two categories when selecting a CDP. When marketers are leading a search, they tend to gravitate towards the third and fourth categories as both categories include a lot of marketing-related features, unlike the first two categories. Delivery CDPs, like the previously mentioned Blueshift and Simon Data, are already participating in ESP RFPs, providing further evidence that, to many marketers, they are indistinguishable from ESPs. Going forward, I believe that campaign and delivery CDPs will eventually fall into the ESCDP category, if they aren’t already there. On the other hand, data and analytics CDPs will continue to focus on the features and functionality that attract the data and IT teams. So I believe that the CDP landscape will split into two distinct groups which will pursue very different paths in the future.

What’s a Brand to do?

Follow these 5 steps, and you will likely avoid making platform mistakes in the near future:

- Do your homework, or hire a consultant who has already done his or hers. What you’ve just read here is a good starting point!

- Create a detailed requirements document for your data management and digital messaging needs. This is a crucial step in order to prevent buying more technology than you need in overlapping platforms

- Determine where you want those requirements addressed. In a CDP managed by IT/Data, or in an ESP managed by marketing? The worst thing you can do is to conduct simultaneous RFPs for both platforms, that are done independently of one another.

- Conduct a gap analysis between the capabilities of your current ESP and your requirements document. If there are significant gaps, are those better addressed by a better ESP, an ESCDP or a CDP?

- Depending on the answer to #4, your next step is likely to be some kind of RFP(s). This is when the person you brought in in #1 will come in extremely handy!

Good luck! You don’t have to be perfect to get all this right. You just have to make your decisions for the right reasons!

Editor's Note: Chris will be leading a discussion on this post on the weekly OI-members-only Live Zoom, Thursday, August 11, 2022, 12:00 Noon ET. Not an OI member? Email Jeanne for a guest pass (limited guest passes available; first come, first served). Or join OI and you can be with us every week for networking and discussion!

Photo by Clay Banks on Unsplash

Photo by Clay Banks on Unsplash

How to resolve AdBlock issue?

How to resolve AdBlock issue?